import {secondary_chart} from "https://observablehq.com/d/01f06bc0b46dd975"

viewof options = Inputs.radio(new Map([["Highlight Gold Decline",0], ["Highlight JP Morgan's Loan",1]]), {value: 0})

secondary_chart(options)Recreating Antique US Treasury Report with D3

Concept

D3

Plus, learn the story of the Panic of 1893

I recently finished reading A Man of Iron: The Turbulent Life and Improbable Presidency of Grover Cleveland by Troy Senik, which covers the fascinating life of the only president to serve two non-consecutive terms.

President Cleveland’s second term was largely defined by the Panic of 1893 and his attempts to keep the United States on the gold standard, which culminated in JP Morgan, the financier, providing a loan to the US Treasury.

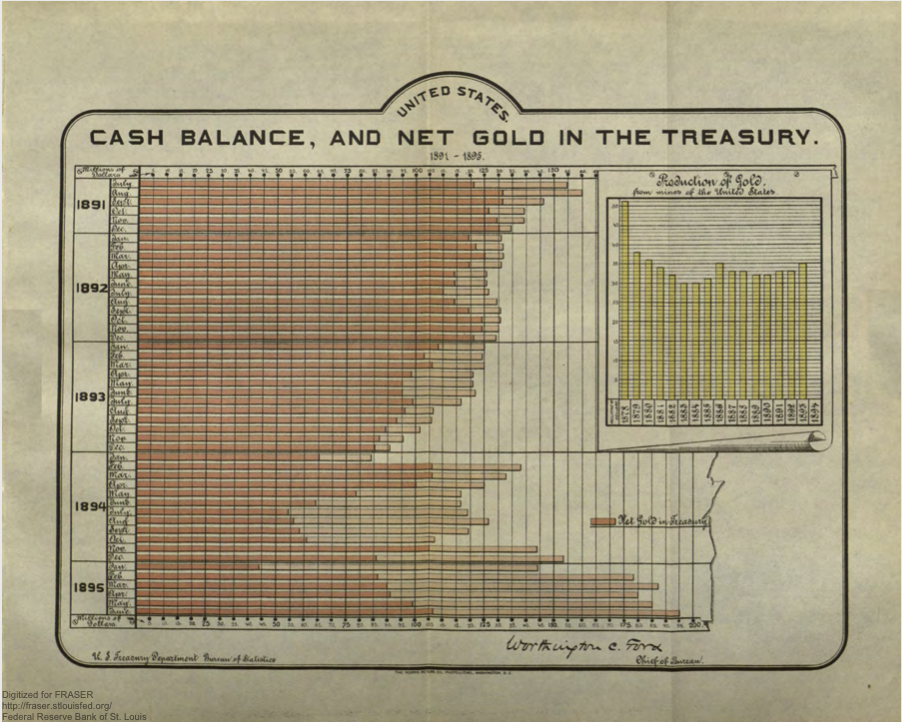

Being someone who is interested in economic history, I wanted to make a data visualization to tell this story and I came across this historic data visualization.

Published in 1895, this hand drawn data visualization shows the volatile net gold balance (dark brown bar) held by U.S. Treasury during the crisis, with the cash balance in the lighter brown. (Note: Cash in those days included an assortment of moneys, including silver certificates.)

You can find this visualization and its data on pages 119 through 121 here

Recreating this Visualization

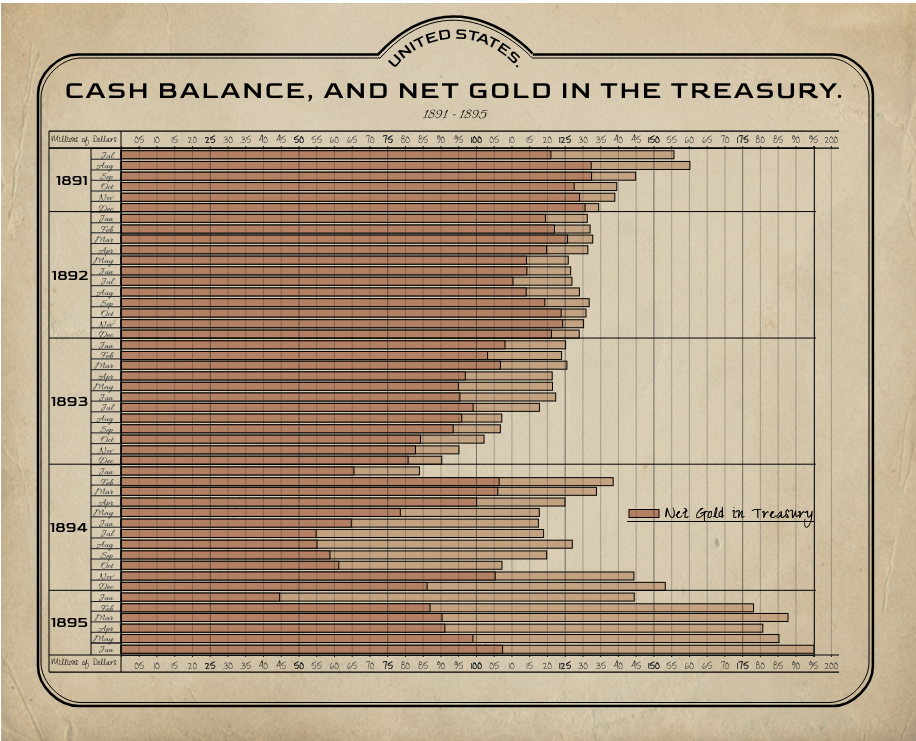

I decided to recreate this data visualization using D3. D3.js provides the developer with far more precision than other data viz tools, so it was ideal for recreating an old data visualization with so many ornate details and reference lines.

While it’s not a perfect replication, it certainly captures the spirit of the original

You can find the code here.

Context: Grover Cleveland, the Gold Standard, and JP Morgan’s Bailout

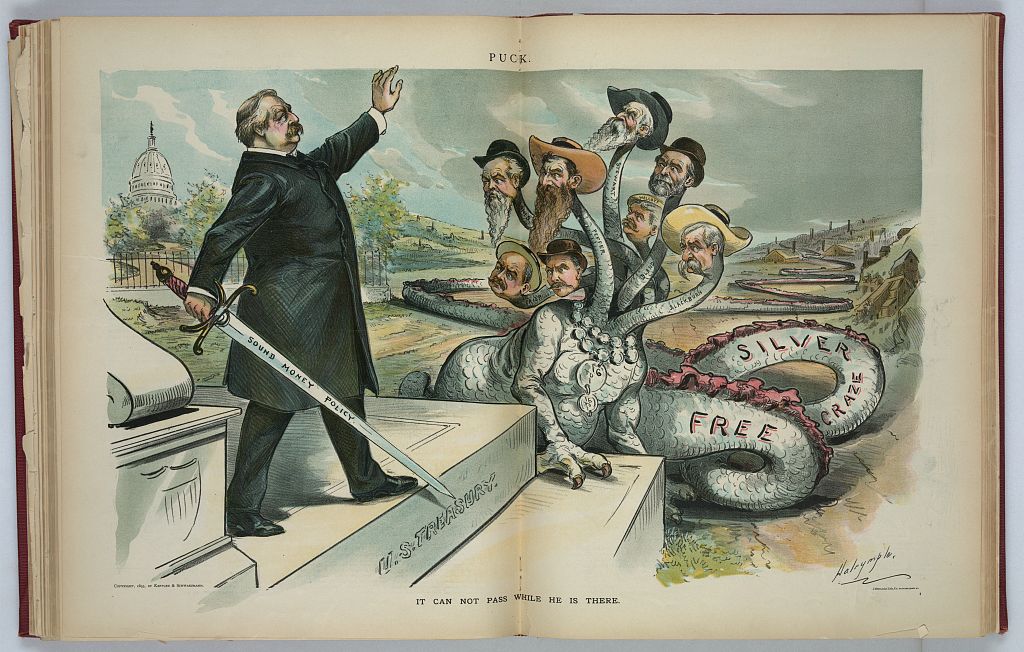

One of President Cleveland’s signature policy positions both before and during the economic crisis was to remain on the gold standard.

At the time, this was aligned with mainstream economic thinking, particularly within the business community. Silverites, such as William Jennings Bryan, who wished to create inflationary pressure by expanding the money supply with silver backed currency, were considered heterodox.

However, we know today that the gold standard tends to cause deflationary pressures during economic crises, as many citizens will trade their paper currencies in for gold, thus reducing amount of money in circulation. This is similar to a bank run, except in this case, the bank run is on the U.S. Treasury.

President Cleveland used various methods maintain a sufficient amount of gold in the Treasury, but these efforts failed to prevent a rapid drop in gold deposits from November 1894 until February 1895.

The visualization below has the same data as the one above, but we narrow our focus to the key dates leading to the bailout and show the rapid decline leading to J.P. Morgan’s loan. The decline in gold by February 1895 is a crude estimate based on the fact that JP Morgan’s loan was for $65 million.

Net Gold in U.S. Treasury

This rapid decline in gold deposits meant that President Cleveland had little time to find a solution. He turned to JP Morgan to provide a large loan of gold in February 1895. This would be the first time that JP Morgan bailed out the US financial system. The Federal Reserve System was eventually created to fulfill this role and prevent one banker from having so much power over the economy.